Benefits of reading candlestick patterns for trading.How to detect the candlestick patterns in actual charts?.Difference between Bullish candles and Bearish candles.Candlestick charts vs normal price charts.

Let us begin with the basics as this blog covers: However, if you are new to candlesticks trading, this blog will help you gain a complete understanding of candlesticks. Also having some idea about the various ways in which these candlesticks can be interpreted would be useful. According to Steve Nison, however, candlestick charting came later, probably beginning after 1850.Candlestick patterns play a key role in quantitative trading strategies owing to the simple pattern formation and ease of reading the same.įor using candlestick patterns, you only need to have a basic understanding of how the candlesticks are formed. Much of the credit for candlestick charting goes to Munehisa Homma (1724–1803), a rice merchant from Sakata, Japan who traded in the Ojima Rice market in Osaka during the Tokugawa Shogunate. Some of the earliest technical trading analysis was used to track prices of rice in the 18th century. He makes important discoveries and statistical summaries, as well as a glossary of relevant terms and a visual index to make candlestick identification easy.

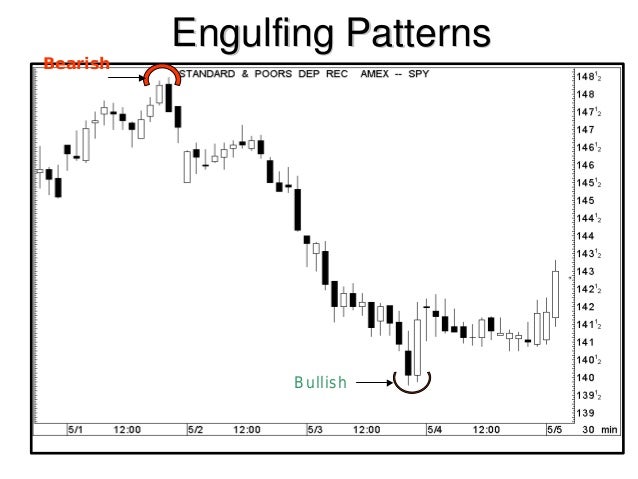

Author Thomas Bulkowski takes an in-depth look at 103 candlestick formations, from identification guidelines and statistical analysis of their behaviour to detailed trading tactics. There are 42 recognized patterns that can be split into simple and complex patterns. The recognition of the pattern is subjective and programs that are used for charting have to rely on predefined rules to match the pattern. In financial technical analysis, a candlestick pattern is a movement in prices shown graphically on a candlestick chart that some believe can predict a particular market movement.

Candlestick and common candlestick patterns

0 kommentar(er)

0 kommentar(er)